Macro trends and long-horizon returns

Abstract

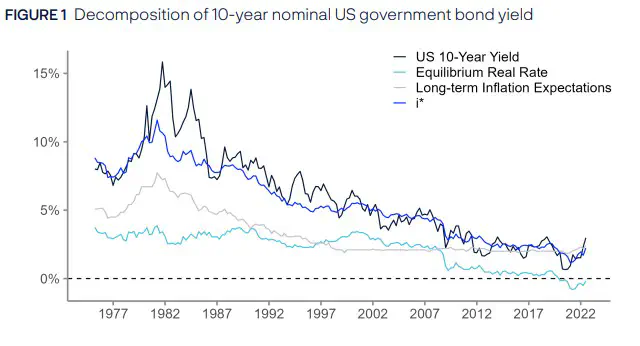

We outline a macro-finance model for simulating long-horizon returns on government bonds and multi-asset portfolios. We show how the determinants of return distributions change across different investment horizons, and discuss differences in prospective returns on long- and short-duration bonds

Publication

NBIM Discussion Note