Withdrawals from the GPFG and potential trade-offs

Abstract

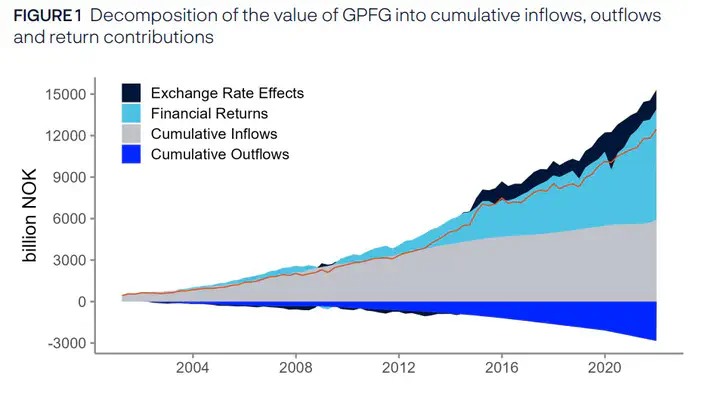

We outline a simulation model of the Norwegian economy and the Government Pension Fund Global. We explore the trade-off between spending from the fund in line with expected returns, and spending counter-cyclically in Norway. We analyse the cyclical properties and sustainability of a range of alternative rules for guiding withdrawals from the fund.

Publication

NBIM Discussion Note